|

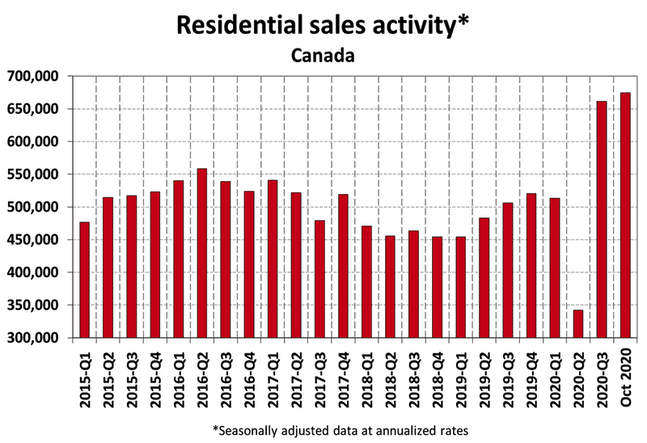

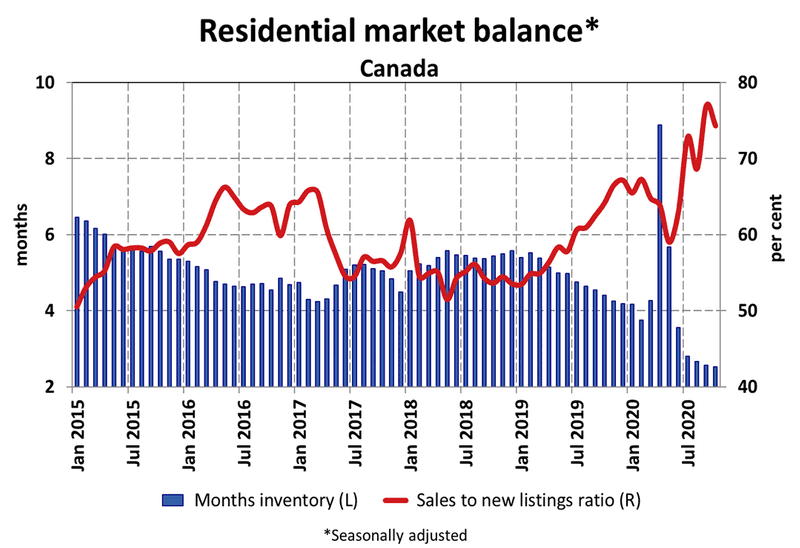

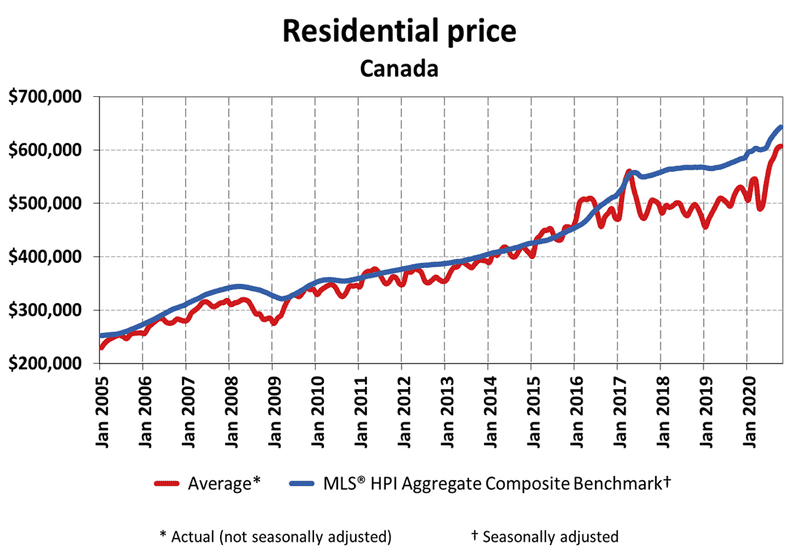

To provide an update on what's happening in Canada's National Home Market, I'd like to start with an overview on residential transaction activity. Sales transactions are setting all-time records, as we have experienced historically strong levels of transactions over the past several months. Residential inventory remains low, relative to the amount of transactions that are taking place. When transaction demand is high and supply of inventory is low, this impacts the value of housing and pushes prices upward. As you can see in the chart above, the residential market balance shows the percentage of new listings being sold (Sales-to-new-listings ratio) and the months of inventory available. When the sales-to-new-listings ratio is above 60%, this is considered a 'seller's market'. The chart above illustrates what has happened to property values, due to the impacts of low supply of inventory and high demand from buyers.

Who are the homebuyers that are propelling the market? Over the past year, approximately 45% of homebuyers purchased property for the first time. Of these first-time buyers, most of the activity occurred in the 25-34 age bracket (known as millennials). Many millennials view this time as an opportunity to get into the market, as homeownership is one of the preferred methods for building wealth. In Canada, 61% of first-time buyers purchased a detached house. I believe the demand for detached housing is attributed to the low interest rates currently available. Since many homebuyers now have more purchasing power, due to low borrowing costs, they have opted for a larger home. I'm noticing a surge in activity in the detached/semi-detached market. Every realtor I've spoken to has noticed a similar pattern over the past several months. So where will the housing market go from here? Eventually, as detached/semi-detached prices increase in value, they will become too expensive for the average homebuyer. Prospective buyers won't be able to qualify for the house they want. I believe there will be a gradual shift in demand from houses to condos, simply due to affordability. This will have a more significant impact on the larger metropolitan markets in Canada, including Toronto. The average price of a detached house in Toronto is currently $1,470,857, while the average semi is $1,154,087. As those values continue to increase, a higher proportion of first-timers will be priced out of the market. What's going on with the condo market? According to statistics Canada, 41.2% of first-time buyers are under the age of 35 (millennials). Specifically in Toronto, I expect to see a large portion of these buyers decide to make a condo purchase over the next 1-2 years. The average Toronto condo is currently $668,161. Even though the average has increased 0.8% on a year-over-year basis, condo values have come down approx 5-10% from their peaks earlier this year. Anecdotally, I've noticed some downtown condos being sold for 50-100k less than what they were being sold for in Feb 2020. Condos that I normally expect would sell at 700k are not even getting 650k offers. If I can get that condo today for 600k, that's a great deal to me. When a savvy buyer finds a desperate seller, it can be a huge WIN for that buyer. My point is there is opportunity in this current market that I don't think we will see again for a long time. If you're considering a property purchase, there's a lot to learn. At this time, I'm helping several buyers purchase their first property. The condo market is rampant with inventory and appears to be one of the best opportunities to buy in downtown Toronto in over 5+ years. If you've been waiting on the sidelines, now is the time. We might not see condo prices this low EVER again. For those of you that take this opportunity to get into the market, you will be glad you did - and see a nice return on your investment. Sources: - https://creastats.crea.ca/en-CA/ - https://mortgageproscan.ca - https://www150.statcan.gc.ca/n1/en/pub/11-627-m/11-627-m2019091-eng.htm

3 Comments

|

AuthorStefan believes in providing a supportive and well-informed experience for his clients. Archives

January 2021

Categories |

RSS Feed

RSS Feed