|

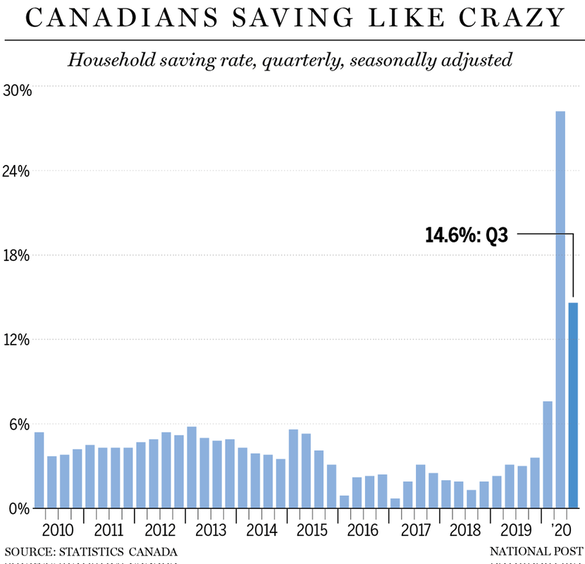

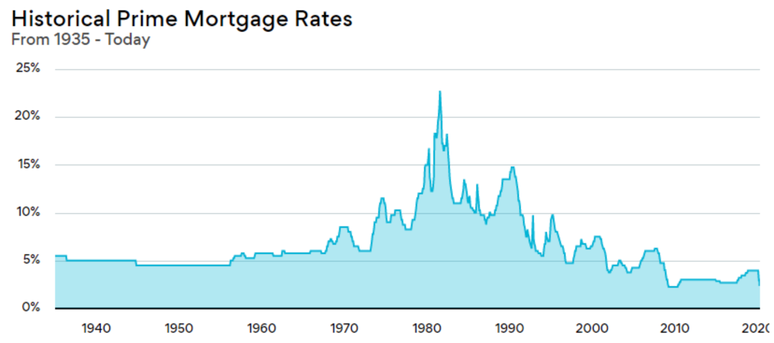

Let's take a moment to acknowledge how difficult this past year was for many of us. Given the pandemic, would anyone have predicted the Canadian housing market to have its best sales year on record? Real estate was one of the bright spots in an overall beaten up economy. Now that we have started a new year, I thought I'd provide some market themes to keep in mind, as we attempt to move forward from the unpredictable year of 2020. I've outlined 5 reasons why I'm bullish on Canadian real estate in 2021. I believe the factors listed below will allow the housing market to remain a growth driver in the economy. In fact, I'm more optimistic on 2021 in a way that I haven't felt in years past. Reason #1: Canadians Are Saving Like Crazy In pre-COVID-19 times, the household savings rate hovered somewhere between zero and a bit more than five per cent of disposable income, according to Statistics Canada data. It then shot up to a seasonally-adjusted annual rate of 5.9 per cent in the first quarter of 2020, 27.5 per cent in the second quarter and 14.6 per cent in the third quarter, according to the agency. The large sums of cash lying around could be put towards bigger purchases, such as residential real estate (an asset class that has held up so far during the pandemic). Reason #2: Borrowing Rates Are Incredibly Low The demand for housing can be attributed to the low interest rates currently available. Since homebuyers now have more purchasing power, due to low borrowing costs, many buyers have purchased their first home, while others have opted for a larger home. When we look at the historic prime mortgage rate over several decades, we see that the current rate is very close to its historic low: Reason #3: The Vaccine Is Available and Being Implemented The vaccine is now available in Canada and is currently being administered to health care workers and the elderly, as it should be. I'm not an expert in this field. I don't know when the vaccine will be widely available to everyone and how it will affect society. I do believe sometime this year a protocol for new immigration to Canada will be available and normal immigration patterns will resume. The federal government is looking to increase the number of permanent residents to Canada, which will lead to population and employment growth. These components always impact the demand of residential real estate. Reason #4: Immigration Will Ramp Up (Federal Government Mandate) The pandemic has resulted in no real immigration to Canada in 10+ months. The federal government has recently announced a plan to increase immigration and allow 1.2 million new permanent residents over the next three years, starting with 401,000 new residents in 2021. A large portion of these residents will move to Toronto. This will impact residential rental values as demand pressures will balance out the available supply. Property investors will be able to collect higher rental income compared to the current market. Hence, investors will be the early demand drivers for the residential market. Reason #5: Overall Consumer Confidence That 2021 Will Be Better Than 2020 Consumers in Canada enter the year riding a wave of optimism that the worst is over. It’s a remarkable recovery that highlights just how much Canadian households have emerged from the deep economic crisis largely intact - cushioned by massive income support payments, a strong rebound in jobs, surging home prices and stock market gains. That’s a positive signal for the overall economy, stoking expectations of a rush in consumer spending once restrictions are finally lifted. If you have any thoughts of buying or selling, feel free to reach out for your private consultation.

We wish you and your family health and prosperity. Sincerely, Stefan Lupul

5 Comments

|

AuthorStefan believes in providing a supportive and well-informed experience for his clients. Archives

January 2021

Categories |

RSS Feed

RSS Feed