Pre-Construction Condos

FAQ

- DO I NEED A MORTGAGE PRE-APPROVAL TO PURCHASE A PRE-CONSTRUCTION CONDO?

- Yes. For the most part, condo builders will require a mortgage pre-approval from you for your contract to be in good standing. This is a safety measure put in place to help curb speculative investment from over-leveraged parties and to ensure that the purchasers can afford to close on the property when the time comes, rather than to default. You will require a mortgage pre-approval letter after signing your agreement within 10 business days but this is not an actual mortgage.

- WHEN DO I NEED TO ARRANGE MY MORTGAGE?

- Your mortgage loan will start on final closing, not on occupancy. Usually a mortgage broker can start the process 1 to 2 months prior to the closing date. Final closing is when the condo building is completed and is officially registered with the municipality. This is also when you’ll receive title to your unit.

- WHAT IS THE DIFFERENCE BETWEEN MORTGAGE AND OCCUPANCY FEES?

- The difference is the principal portion of the mortgage, which is omitted as the purchaser still doesn’t have title until after registration. Once registered, a mortgage begins in lieu of occupancy fees, which will include the principal portion in the payment.

|

OCCUPANCY FEES

Mortgage Interest Condo Fees Property Taxes |

MORTGAGE

Principal and Interest Condo Fees Property Taxes |

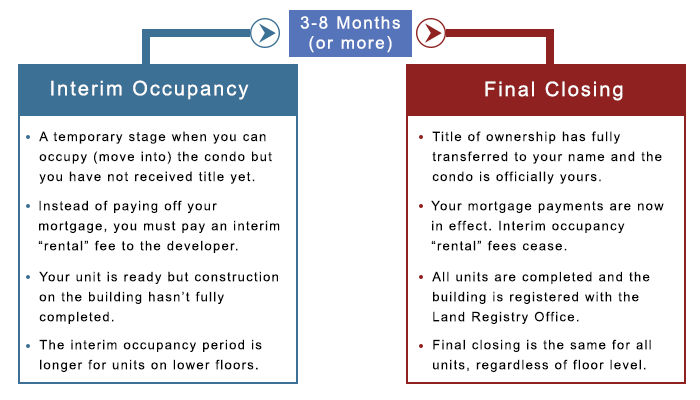

- WHAT IS THE DIFFERENCE BETWEEN INTERIM OCCUPANCY AND FINAL CLOSING?

- Interim occupancy is when your final 5% deposit is due, you get the keys and can begin renting your property. Registration (Final Closing) is the date when the title is transferred into your name from the builder. Registration is also when your closing costs are due. Closing costs include Land Transfer Tax, development charges, legal expenses and HST, if it’s owing.

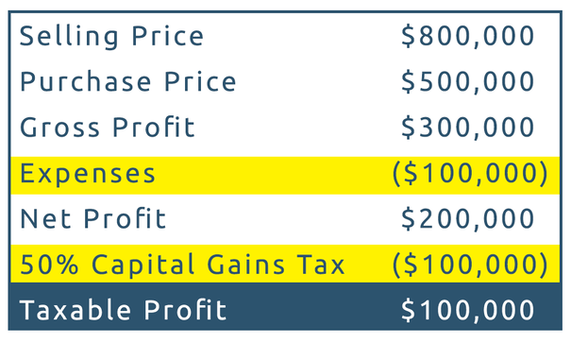

- HOW MUCH OF MY PROFIT IS TAXED?

- When you sell your investment property, you are required to pay a 50% Capital Gains Tax on your Net Profit. You are entitled to deduct expenses used to achieve your investment from these gains. For example:

- WHY SHOULD I BUY PRE-CON VS RESALE?

- The best part about buying something new - it has never been used or occupied by another person. Whether it's a car, phone or laptop - a lot of people prefer to buy a new product. A new condo will have very little or no maintenance needed for upkeep. Additionally, appreciation of value is often higher and more rapid than resale because developers increase the price of units during the phases of construction.

- WHY DO I NEED AN AGENT WHEN I CAN GO STRAIGHT TO THE BUILDER?

- Buying real estate is one of the largest purchases you might ever make. As platinum brokers, we protect your interests by representing you, not the developers. Keep in mind that the builder's sales team is interested in selling their project only. We, on the other hand, are here to support you in any project of interest and show you other options to consider. We’ll guide you through the complicated process and make sure there are no surprises. One of the biggest perks is that we have access to these projects before they’re released to the public, giving you first choice of units at the lowest price. By the time the developer is selling to the public, many of the units will likely be sold and the remaining inventory will have increased in price.

- WHAT TYPE OF UNIT IS MOST POPULAR FOR INVESTMENT?

- We recommend a 1+Den or 2 Bed, as they tend to attract more professionals or young families. 1+Dens are the most desired layout by tenants in Toronto, simply for the flexibility.

- WHAT IS THE INITIAL DEPOSIT AMOUNT?

- In Toronto it can range from $5,000 to 5% of purchase price.

- CAN I CHANGE MY MIND AND GET BACK MY DEPOSIT? (COOLING PERIOD)

- Yes, you have 10 days from signing the agreement to make a final decision. This is known as the 'Cooling Period' (10-day rescission)

- WHAT ELSE SHOULD I KNOW ABOUT PAYMENTS?

- Avoid non-sufficient-fund (NSF) fees! One thing we advise our clients to do is set reminders on your calendar for the post-dated cheque withdrawal dates. It's very easy to forget and if you neglect to have the amount in your account, you will be charged an NSF fee, which could be anywhere from $250 to $750. Understandably, this is not fun, especially if you aren’t expecting it. Plan ahead!

- DO I NEED A LAWYER?

- Yes. A good lawyer will look out for your interests and help you understand all your rights and responsibilities. Ask us who we recommend.

- WHAT SHOULD I EXPECT AT CLOSING?

- There are additional costs at closing, along with some specialized paperwork. Aside from the down payment you give to the developer, be prepared to set aside 4-5% percent of the final purchase price for final closing costs. This includes your Land Transfer Tax, development charges, legal fees and HST, if owing. We’ll guide you through this process so it seems less overwhelming.

- WHAT ARE DEVELOPMENT CHARGES?

- Development charges are taxes imposed by the city of Toronto and passed on to purchasers of newly built property. These taxes are used to help the development of the city, such as park levies, education levies, water and sewer levies. These taxes are imposed on purchasers on the registration date and can be used as capital losses against their gains when the investor sells the property down the road. We make the developer cap the development charges on every development to protect the purchaser.

- WHAT ARE THE RULES AROUND BUILDER DELAYS?

- Builders are governed by Tarion which enforces the Ontario New Home Warranties Plan Act and Regulations. This act stipulates different requirements that mandate builders to let purchasers know if there will be any delays. They owe different amounts of notice depending on where they are in the construction process. For a comprehensive breakdown on this visit Tarion.com

- WHEN IS MY HST OWED ON A SALE?

- Usually when buying new construction housing, HST is in addition to the purchase price. In Ontario, the HST rate on new construction housing will be 13% and the tax amount would be due on final closing. If you’re purchasing property for an immediate relative to use as their primary residence, you’re entitled to an HST rebate. If you’re buying as an investor and planning to rent out the property for a minimum of one year, you may also qualify for an HST rebate. Upon registration (final closing), when all of your fees are due, you will also be mandated to pay HST. You will get a full refund 4 to 6 weeks after registration provided you have a one year lease in place. Your lawyer will be able to assist you with rebate forms. If you do not rent out your property for the minimum one year you are not eligible for the HST Rebate. See Revenue Canada's website for more details.

- WHAT IF MY FINANCIAL SITUATION CHANGES AND I DON'T WANT TO CLOSE ON THE PROPERTY?

- Usually builders will allow something called an “assignment” or “assignment sale.” This allows you to sell your contract prior to the final closing. As your broker, we always ensure this clause is written into your purchase agreement, but be sure to read the contract carefully as there may be some rules surrounding it. Some developers will charge an assignment fee (ranging from $1,000 to $6,000) and some will waive this fee. As long as the building has a certain number of units already sold (in most cases 75% or more) the builder usually allows this kind of sale.

- WILL MY CONDO MAINTENANCE FEE GO UP EVERY YEAR?

- The maintenance fee that is stated on the sales agreement is usually what you will pay for the first year. Part of your maintenance fee contributes to a condominium reserve fund, managed by the building's condo board. The reserve fund is allocated for items in the building that need significant repairs. During the first few years, there's not much to maintain, as the building is new. After a few years, the condo board usually increases the fees by approximately three to five per cent annually to cover inflation.

CLOSING COSTS

- Land Transfer Tax - This is based on purchase price - use our calculator

- Maintenance Fees - Approximately $400-$1000

- Reserve Fund Fees - usually equivalent to two months of maintenance fees, which could be approximately $1000

- Property Taxes - This can vary, but our estimate for the City of Toronto is 0.75% of purchase price

- Utility hookup fees, Tarion Warranty Enrollment Fee, Deposit Administration/Letter Charges, Discharge of Construction Mortgage, Site review by Tarion, Electronic Registration Fee, HST on Appliances - These are miscellaneous costs that can add up to approximately $4,000-$5,000

- Development Levies, Park Levies, Community Improvement Fees, Art and/or Education Levies - Development levies are taxes imposed by the city of Toronto and passed on to purchasers of newly built property. These taxes are used to help the development of the city, such as park levies, education levies, water and sewer levies. These taxes are imposed on purchasers on the registration date and can be used as capital losses against their gains when the investor sells the property down the road. We make the developer cap the development charges on every development to protect the purchaser. (Approximately $5,000-10,000)

- Buyer’s Legal Fees - $1,900