|

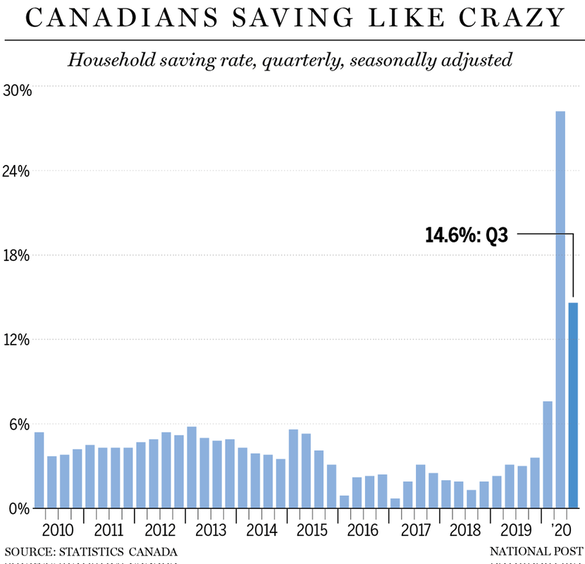

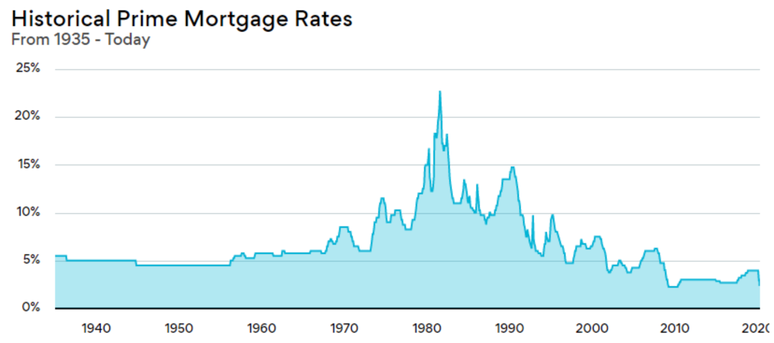

Let's take a moment to acknowledge how difficult this past year was for many of us. Given the pandemic, would anyone have predicted the Canadian housing market to have its best sales year on record? Real estate was one of the bright spots in an overall beaten up economy. Now that we have started a new year, I thought I'd provide some market themes to keep in mind, as we attempt to move forward from the unpredictable year of 2020. I've outlined 5 reasons why I'm bullish on Canadian real estate in 2021. I believe the factors listed below will allow the housing market to remain a growth driver in the economy. In fact, I'm more optimistic on 2021 in a way that I haven't felt in years past. Reason #1: Canadians Are Saving Like Crazy In pre-COVID-19 times, the household savings rate hovered somewhere between zero and a bit more than five per cent of disposable income, according to Statistics Canada data. It then shot up to a seasonally-adjusted annual rate of 5.9 per cent in the first quarter of 2020, 27.5 per cent in the second quarter and 14.6 per cent in the third quarter, according to the agency. The large sums of cash lying around could be put towards bigger purchases, such as residential real estate (an asset class that has held up so far during the pandemic). Reason #2: Borrowing Rates Are Incredibly Low The demand for housing can be attributed to the low interest rates currently available. Since homebuyers now have more purchasing power, due to low borrowing costs, many buyers have purchased their first home, while others have opted for a larger home. When we look at the historic prime mortgage rate over several decades, we see that the current rate is very close to its historic low: Reason #3: The Vaccine Is Available and Being Implemented The vaccine is now available in Canada and is currently being administered to health care workers and the elderly, as it should be. I'm not an expert in this field. I don't know when the vaccine will be widely available to everyone and how it will affect society. I do believe sometime this year a protocol for new immigration to Canada will be available and normal immigration patterns will resume. The federal government is looking to increase the number of permanent residents to Canada, which will lead to population and employment growth. These components always impact the demand of residential real estate. Reason #4: Immigration Will Ramp Up (Federal Government Mandate) The pandemic has resulted in no real immigration to Canada in 10+ months. The federal government has recently announced a plan to increase immigration and allow 1.2 million new permanent residents over the next three years, starting with 401,000 new residents in 2021. A large portion of these residents will move to Toronto. This will impact residential rental values as demand pressures will balance out the available supply. Property investors will be able to collect higher rental income compared to the current market. Hence, investors will be the early demand drivers for the residential market. Reason #5: Overall Consumer Confidence That 2021 Will Be Better Than 2020 Consumers in Canada enter the year riding a wave of optimism that the worst is over. It’s a remarkable recovery that highlights just how much Canadian households have emerged from the deep economic crisis largely intact - cushioned by massive income support payments, a strong rebound in jobs, surging home prices and stock market gains. That’s a positive signal for the overall economy, stoking expectations of a rush in consumer spending once restrictions are finally lifted. If you have any thoughts of buying or selling, feel free to reach out for your private consultation.

We wish you and your family health and prosperity. Sincerely, Stefan Lupul

5 Comments

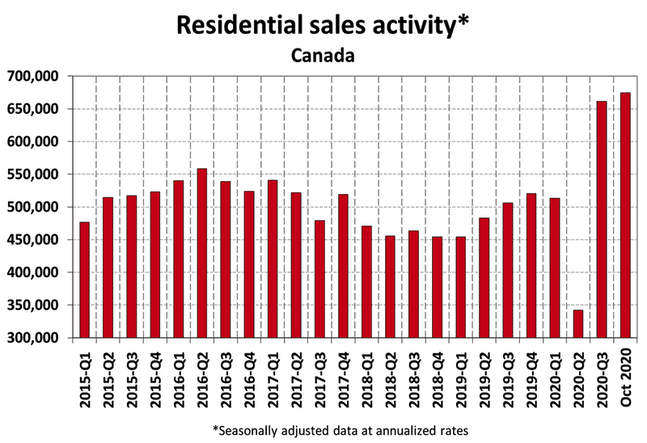

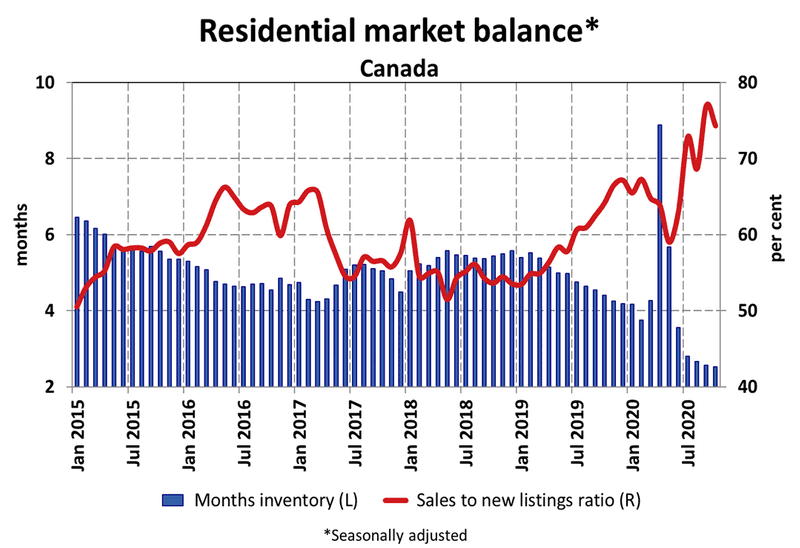

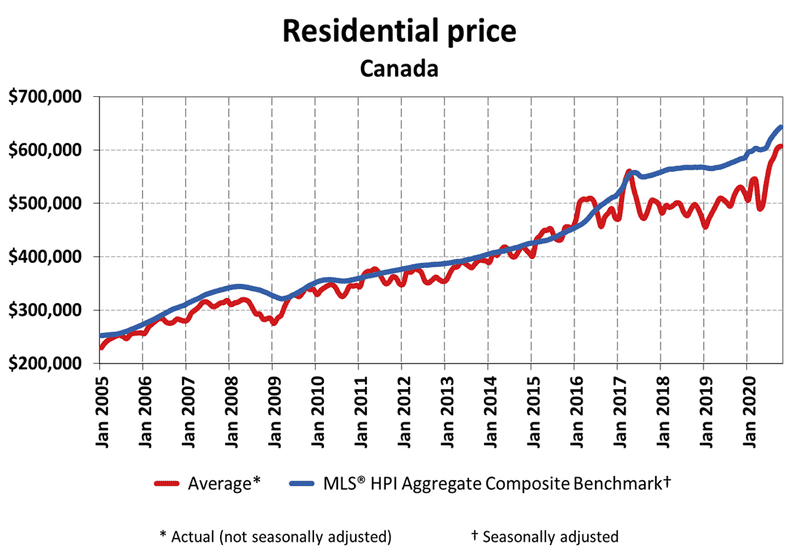

To provide an update on what's happening in Canada's National Home Market, I'd like to start with an overview on residential transaction activity. Sales transactions are setting all-time records, as we have experienced historically strong levels of transactions over the past several months. Residential inventory remains low, relative to the amount of transactions that are taking place. When transaction demand is high and supply of inventory is low, this impacts the value of housing and pushes prices upward. As you can see in the chart above, the residential market balance shows the percentage of new listings being sold (Sales-to-new-listings ratio) and the months of inventory available. When the sales-to-new-listings ratio is above 60%, this is considered a 'seller's market'. The chart above illustrates what has happened to property values, due to the impacts of low supply of inventory and high demand from buyers.

Who are the homebuyers that are propelling the market? Over the past year, approximately 45% of homebuyers purchased property for the first time. Of these first-time buyers, most of the activity occurred in the 25-34 age bracket (known as millennials). Many millennials view this time as an opportunity to get into the market, as homeownership is one of the preferred methods for building wealth. In Canada, 61% of first-time buyers purchased a detached house. I believe the demand for detached housing is attributed to the low interest rates currently available. Since many homebuyers now have more purchasing power, due to low borrowing costs, they have opted for a larger home. I'm noticing a surge in activity in the detached/semi-detached market. Every realtor I've spoken to has noticed a similar pattern over the past several months. So where will the housing market go from here? Eventually, as detached/semi-detached prices increase in value, they will become too expensive for the average homebuyer. Prospective buyers won't be able to qualify for the house they want. I believe there will be a gradual shift in demand from houses to condos, simply due to affordability. This will have a more significant impact on the larger metropolitan markets in Canada, including Toronto. The average price of a detached house in Toronto is currently $1,470,857, while the average semi is $1,154,087. As those values continue to increase, a higher proportion of first-timers will be priced out of the market. What's going on with the condo market? According to statistics Canada, 41.2% of first-time buyers are under the age of 35 (millennials). Specifically in Toronto, I expect to see a large portion of these buyers decide to make a condo purchase over the next 1-2 years. The average Toronto condo is currently $668,161. Even though the average has increased 0.8% on a year-over-year basis, condo values have come down approx 5-10% from their peaks earlier this year. Anecdotally, I've noticed some downtown condos being sold for 50-100k less than what they were being sold for in Feb 2020. Condos that I normally expect would sell at 700k are not even getting 650k offers. If I can get that condo today for 600k, that's a great deal to me. When a savvy buyer finds a desperate seller, it can be a huge WIN for that buyer. My point is there is opportunity in this current market that I don't think we will see again for a long time. If you're considering a property purchase, there's a lot to learn. At this time, I'm helping several buyers purchase their first property. The condo market is rampant with inventory and appears to be one of the best opportunities to buy in downtown Toronto in over 5+ years. If you've been waiting on the sidelines, now is the time. We might not see condo prices this low EVER again. For those of you that take this opportunity to get into the market, you will be glad you did - and see a nice return on your investment. Sources: - https://creastats.crea.ca/en-CA/ - https://mortgageproscan.ca - https://www150.statcan.gc.ca/n1/en/pub/11-627-m/11-627-m2019091-eng.htm Hello, Thought I'd provide some perspective on what's happening in Toronto's condo market. There is no doubt that the pandemic has caused significant disruption in the supply and demand balance of Toronto condos. Many downtown neighbourhoods are experiencing double the amount of condo inventory compared to last year. This inevitably has affected prices, since many listings are getting 'lost in the pile' and not getting enough visibility from a shrinking condo buyer population. When buyers have a surplus of choice, they can effectively be more selective with the product they are looking to purchase. Real estate is no different. Prospective buyers might even get lucky and find a deal from a desperate condo seller. Which brings me to my next point - finding a deal. Allow me to ask you a question - If a new couch you've been eyeing on Wayfair normally costs $700 but goes on sale for $600, would that be a good deal to you? A similar scenario is happening in the condo market. Condos that I normally expect would sell at 700k are not even getting 650k offers. If I can get that condo today for 600k, that's a great deal to me. Believe it or not, I have actually seen this big of a price drop happen in a condo sale recently. When a savvy buyer finds a desperate seller, it can be a huge WIN for that buyer. My point is there is opportunity in this current market that I don't think we will see again for a long time. For those that decide to take advantage of this time and purchase that condo, you could expect some post-covid appreciation in the short term. In the long term, you will see significant appreciation. Buying at the low point of the market will secure a great return-on-investment (ROI) by holding the property for a minimum of three years. If you could go back to April and buy up shares of Apple (APPL) during the low points of the pandemic, would you seize the opportunity? Apple Inc. Share So how will the condo market recover? The pandemic has resulted in no real immigration to Canada in 8 months. Immigration leads to population and employment growth. These components impact the demand of residential real estate. The federal government has recently announced a plan to increase immigration and allow 1.2 million new permanent residents over the next three years, starting with 401,000 new residents in 2021. A large portion of these residents will move to Toronto. This will impact condo rental values as demand pressures will balance out the available supply. Condo investors will be able to collect higher rental income compared to the current market. Hence, investors will be the early demand drivers of the condo resale market. I believe a more gradual and significant impact will be the prospective house buyers that just can't qualify to purchase the detached house they want. As detached and semi-detached properties become too expensive, there will be a shift in demand from houses to condos. This is mainly first-time buyers, the largest demographic of the buyer market.

My final point - Never bet against downtown Toronto. The appeal to live downtown is still an attractive option, even throughout the pandemic. I've personally helped more people move downtown in the last 6 months than any other 6 month period in my career. I attribute it mostly to people wanting cheaper rent or taking this opportunity to upgrade their current living situations. It makes sense to move when you can save $200-300/mo on rent or mortgage expenses. Once the vaccine is widely available and normal immigration patterns resume, I believe there will be a bounce back in condo resale and rental values. It's difficult to predict how much longer we will experience a buyer's market in downtown Toronto, time will tell. I do expect a tighter market in the latter part of 2021 as buyer competition emerges. In my opinion, it's only a matter of time before we see multiple offers return to the condo market. |

AuthorStefan believes in providing a supportive and well-informed experience for his clients. Archives

January 2021

Categories |

RSS Feed

RSS Feed